Address

Email address

Phone number

http://ramo.eeRamo

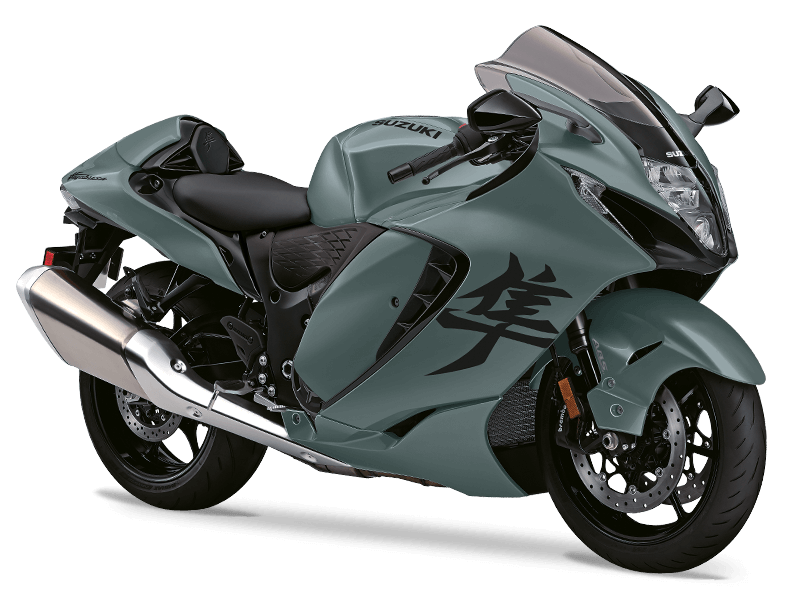

http://ramo.eeRamoTere tulemast Suzuki mootorrataste veebilehele Ramo AS on maaletooja kaubamärkidele

Name

aktsiaselts RAMO

Registry code

10125487

VAT number

EE100417069

Type

AS - Joint Stock Company

Status

Registered

Foundation date

18.09.1996 (29)

Financial year

01.01-31.12

Capital

150 000.00 €

Activity

47831 - 47821 - Retail sale via stalls and markets of textiles, clothing and footwear 95311 - 47811 - Retail sale via stalls and markets of food, beverages and tobacco products 47301 - Retail sale of automotive fuel inc. activities of fuelling stations 47711 - Retail sale of clothing in specialised stores 47631 - Retail sale of music and video recordings in specialised stores

435 968 €

-6 559 €

-1%

936 €

(estimate is approximate)

514 883 €

11

-

No tax arrears

-1%

-1%

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Triinu Raudsepp

| - | - | - | Board member |

| Marju Raudsepp

| - | - | - | Chairman of the board |

| Kati Märdimäe

| - | - | - | Board member |

| Omanikukonto: Ülo Raudsepp

| 96% - 144 710.00 EUR | Board member | - | Shareholder |

| 2019 30.06.2020 | 2020 30.06.2021 | 2021 21.06.2022 | 2022 30.06.2023 | 2023 25.06.2024 | 2024 27.06.2025 | |

|---|---|---|---|---|---|---|

| Total Revenue | 631 483 € | 538 859 € | 718 582 € | 649 605 € | 485 449 € | 433 683 € |

| Net profit (loss) for the period | -6 656 € | -12 590 € | 40 961 € | 6 398 € | -6 559 € | -20 050 € |

| Profit Margin | -1% | -2% | 6% | 1% | -1% | -5% |

| Current Assets | 743 911 € | 683 000 € | 663 339 € | 630 998 € | 614 021 € | 607 526 € |

| Fixed Assets | 17 328 € | 12 090 € | 29 219 € | 18 351 € | 14 756 € | 11 444 € |

| Total Assets | 761 239 € | 695 090 € | 692 558 € | 649 349 € | 628 777 € | 618 970 € |

| Current Liabilities | 268 536 € | 218 269 € | 162 645 € | 116 709 € | 106 451 € | 120 537 € |

| Non Current Liabilities | 6 030 € | 2 738 € | 14 869 € | 11 198 € | 7 443 € | 3 601 € |

| Total Liabilities | 274 566 € | 221 007 € | 177 514 € | 127 907 € | 113 894 € | 124 138 € |

| Share Capital | 150 000 € | 150 000 € | 150 000 € | 150 000 € | 150 000 € | 150 000 € |

| Equity | 486 673 € | 474 083 € | 515 044 € | 521 442 € | 514 883 € | 494 832 € |

| Employees | 5 | 5 | 5 | 5 | 5 | 4 |

| Turnover | State taxes | Labor taxes and payments | Employees | |

|---|---|---|---|---|

| 2025 Q4 | 98 313 € | 14 224 € | 4 276 € | 4 |

| 2025 Q3 | 112 737 € | 22 518 € | 5 905 € | 4 |

| 2025 Q2 | 205 278 € | 22 407 € | 6 314 € | 4 |

| 2025 Q1 | 125 865 € | 23 485 € | 7 096 € | 4 |

| 2024 Q4 | 182 379 € | 24 001 € | 6 575 € | 4 |

| 2024 Q3 | 140 203 € | 17 974 € | 5 195 € | 4 |

| 2024 Q2 | 165 458 € | 17 211 € | 6 780 € | 4 |

| 2024 Q1 | 162 831 € | 20 669 € | 6 688 € | 4 |

| 2023 Q4 | 148 116 € | 22 845 € | 6 740 € | 4 |

| 2023 Q3 | 137 340 € | 21 937 € | 7 248 € | 4 |

| 2023 Q2 | 214 584 € | 25 196 € | 7 672 € | 4 |

| 2023 Q1 | 216 472 € | 22 929 € | 8 401 € | 4 |

| 2022 Q4 | 183 781 € | 29 565 € | 8 098 € | 5 |

| 2022 Q3 | 219 227 € | 24 142 € | 7 150 € | 5 |

| 2022 Q2 | 257 314 € | 26 501 € | 6 150 € | 5 |

| 2022 Q1 | 311 836 € | 22 066 € | 5 321 € | 5 |